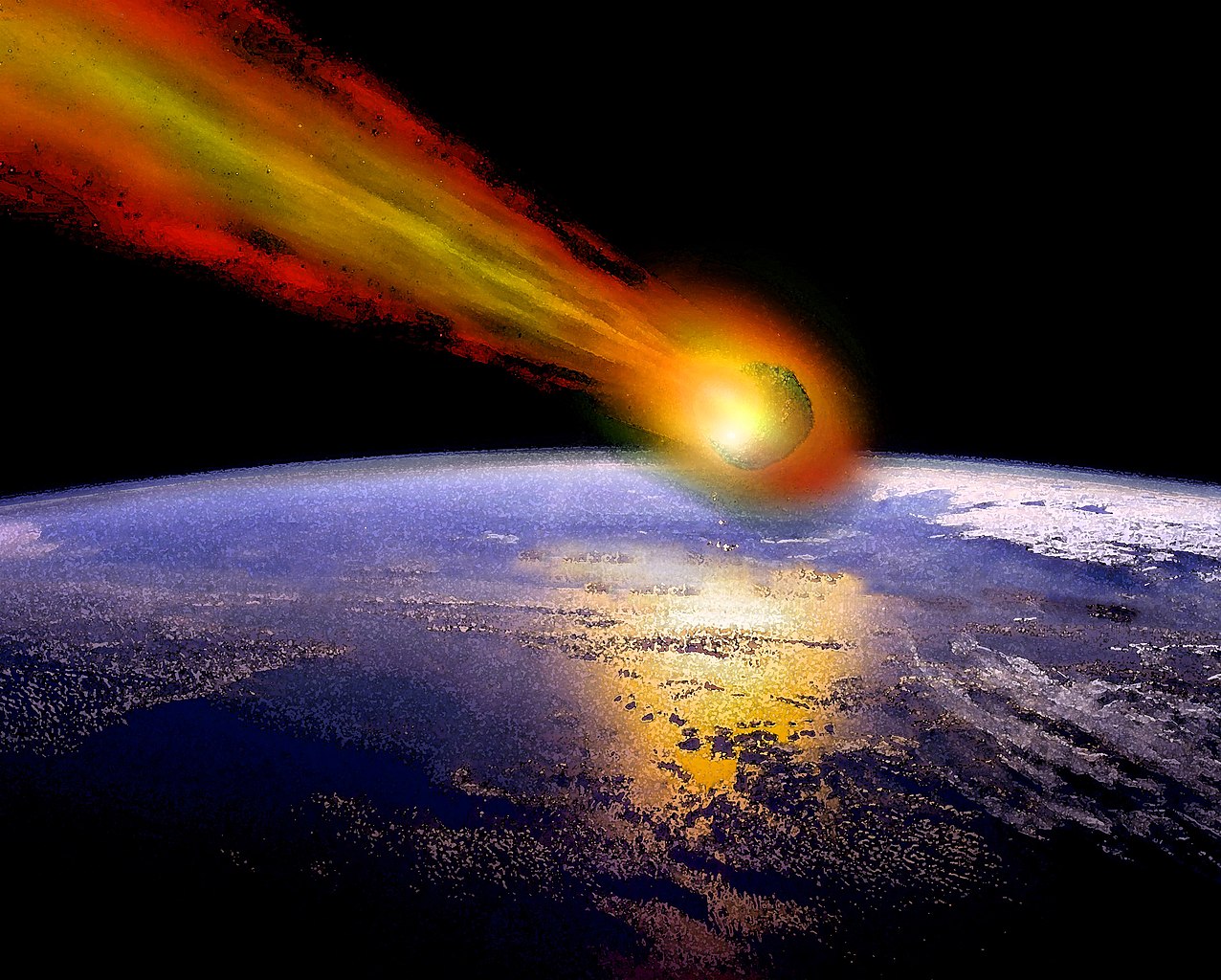

Britain’s imminent energy Armageddon, and how to avoid it: in a long read, Andrew Levi warns that the scale and nature of the crisis is still widely misunderstood, and the measures needed to address it woefully underdeveloped.

Brexit, a unique act of self-harm, worsens the UK’s situation.

Without great good luck, only radical immediate action can avert the worst. But where are the leaders?

Have yourself a very insolvent Christmas

In the TV show Total Wipeout, contestants sought to win £10,000 by defeating all others in a series of extreme, assault-course challenges.

A majority of the UK’s population now confronts the prospect of a far greater test, not of their choosing and with no confidence that there is a support team in the wings ready and willing to save them. As for the prize money, it’s starting to feel like that might not cover an average household’s utility bills from now until Christmas.

Energy-price-shock-induced ruin faces most of the middle class and less prosperous social groups, along with the businesses on which they often rely for a living, not to mention the public institutions – schools, hospitals and many more – which provide much of the bedrock of our society.

Unless unprecedented government action is now taken, the stress on the UK’s economy and society will rapidly become unsustainable.

Darkness

This isn’t hyperbole. Pretty basic arithmetic shows how quickly finances will collapse for tens of millions of people, and hundreds of thousands of businesses in the UK – with devastating knock-on effects on the wider economy as bills remain unpaid, purchases are cancelled, wages are no longer received – unless most of those people’s energy costs are, one way or another, either severely reduced or paid on their behalf.

Without profound and sustained government intervention, starting immediately, the country is in danger of descending into darkness; and in more terrifying ways than one. The 1970s crises will appear as nothing, if we fail.

Prices crisis

Here’s the good news. First: at the time of writing, because Germany has managed to fill its (very large) gas storage facilities faster than expected, there are signs that the price of gas on the international markets may be falling. Second: the Treasury is reported to be preparing to tell the incoming prime minister that UK gas producers and electricity generators might be set to make excess profits of as much as £170bn over the next two years. If, say, half of that (to be cautious) were recovered with a windfall tax, about £40bn a year could be made available to help avoid the worst.

Now the bad news. Prices might not fall much. And £40bn a year, while helpful, is only a fraction of what is required.

Our leaders need to assess a range of scenarios, their likelihoods, and how best to address them. Thousand-page documents doing exactly that litter government, financial and energy company desks around the UK and the world. Let’s see what we can do in a few sides of foolscap (which seems the appropriate format for our era).

We’ve never been here before

Looking back to 1971, the proportion of gross domestic product (GDP: all the economic output of a country in a year) spent on energy in advanced industrial economies has typically been 8 per cent, plus or minus 2 per cent. Some countries have been at, or even a bit above, the top end of that (10 per cent) for extended periods. In the half-century since, no advanced economy has been anywhere close to double the top end (20 per cent).

Just as well. The evidence suggests that energy expenditure levels above 10 -12 per cent of GDP become increasingly – and, eventually, intolerably – stressful and damaging to the economy. Twenty per cent of GDP without far-reaching government help would almost certainly be disastrous, and very swiftly so. Yet a doubling of energy costs for households and businesses and the economy overall, compared to the long-term trend (of 8 per cent or so) now looks an optimistic scenario.

In short, we face imminent energy Armageddon.

In the medium and longer-term, we have the potential to protect ourselves. We could use energy-efficient economic growth to steer our way out of the problem. (It would have to be on a zero-carbon basis as quickly as possible and environmentally sustainable). Larger GDP achieved with similar absolute energy cost means a lower percentage of GDP spent on energy. Insulation and other energy efficiency measures should play a big role. And by reorienting and upgrading our energy provision, we would reduce prices and increase the security of supply.

For this to happen requires a range of domestic and international measures such as massively increased carbon-free energy capacity, much more energy storage, and resilient energy networks across Europe and elsewhere. The broken UK electricity generation market must be fixed. The current regime struggles with crises such as the one we are now experiencing, tending to spike prices to extreme levels. This happens because of a regulatory structure which results in a price set for all electricity providers, several times an hour, according to the most expensive generating capacity required to come on stream to meet demand during that time slot.

But we will never get to any of those measures if we collapse now; or, indeed, if we fail to press ahead far harder, right now in the middle of the immediate crisis, with the radical, strategic actions needed for the longer-term future.

It’s the government, stupid

How do we avoid collapse right now?

Get lucky! We might; but relying on luck would be beyond irresponsible. Energy security is a matter of life or death. For the country. For its people. Collapse can come lightning fast.

The physical presence of energy sources – gas, say – is a necessary but not sufficient condition for energy security. Affordability is key. Without it, the energy might just as well not be there: there is no energy security without affordability.

The government needs to plan, now, how best to direct government finance equal to about 10 per cent of our GDP, to control energy costs for users throughout the economy and society. Let there be no misunderstanding: this is a huge sum of money. And it may be a significant underestimate. But the costs of collapse are vastly, not to say infinitely, higher.

The reasons for the stress which leads to collapse are easy to understand, but worth stating explicitly. For businesses, the ability to afford necessary non-energy inputs is eroded, then disappears; and with it the ability to survive. For households, the ability to afford the essentials of shelter, food, heat and light is eroded, then disappears; and with it the ability to live – safely, healthily, with dignity, or at all. For public institutions, if the budget is fixed and the energy costs go through the roof, it is very soon ‘game over’. The budget decision rests with the funder: the government.

Financial resilience of businesses and households varies widely. Government is another matter, which we are about to come back to. At 20 per cent of GDP going on energy, many – perhaps most – of the normally resilient simply won’t make it; the already vulnerable clearly face devastation.

The only way the funds to close the affordability gap can be mobilised, is by government. Since we are addressing an immediate crisis over the coming months and next few years, we have to accept that we can’t rely on the long-term measures we are (or should be) pursuing: they won’t bite properly until later in the process.

So, what next?

Who wants to be a trillionaire?

Each percentage point of UK GDP is worth more than £20bn a year. That’s the small change of this energy-related effort which is likely to be measured in the order of £200bn a year.

The windfall tax mentioned earlier might be worth £40bn a year. Maybe an equivalent amount in energy expenditure can be cut by energy-saving measures. These can be achieved either by ‘soft’ mandates – using the moral force of government exhortation to encourage energy-saving (although that offers no direct help to those already on the edge); or ‘hard’ – all the way up to legally-mandated and enforced rationing.

Social justice can be advanced as an argument for taxing the wealthiest more; potentially, an increased overall tax take can be justified on inflation control grounds, depending on the economic conditions. But if all the less well-off and most of the middle class, along with a large proportion of businesses, are in financial trouble, taxing them more will increase the stress, leading to increasing numbers of economic, social and human tragedies. As for taxing the wealthiest, it is hard to see a realistic way that will go far towards closing the likely gap.

It seems probable that the UK will need in the order of an additional £100bn in government deficit spending a year, probably for several years. That’s on top of deficit spending running at £100bn and more a year, averaged over the eighteen months to June 2022. We are looking at a total over five years of £1tn or more. To survive the 2020s energy shock.

Cutting back elsewhere to reduce the annual government deficit isn’t an option: not for a government which understands that its job is to protect and serve the country and all its people. Everyone wants the most efficient use of public funds; but the idea that genuine efficiency savings in services like the NHS, education, the armed forces etc can, responsibly, be used to cut existing levels of expenditure, is for the birds. Every pound of efficiency saving needs to be recycled into improving vital public services which are already desperately in need of increased capacity and quality.

“Weil, so schließt er messerscharf, nicht sein kann, was nicht sein darf”

The German poet Christian Morgenstern described in his poem The Impossible Fact how, once convinced prevailing circumstances don’t permit a particular outcome, one can be tempted to conclude it is, therefore, impossible: a man badly injured in a road accident decides the incident shouldn’t have been allowed, and therefore concludes it must all have been a dream.

We can’t survive if coping with this crisis genuinely turns out to be an “impossible fact”. But let’s not convince ourselves – through ignorance or fear, or bad dreams – that there is no way out.

Let’s take a closer look at the money, the geopolitics and the geoeconomics. And if the domestic politics of it all have to be dragged kicking and screaming into a place where the key players do their jobs, rather than indulging their ideological or self-serving preferences, then … well, there will have to be much kicking and much screaming. We can put up with that.

If there is a financial gap which must be filled, the government must create the money. Doing so without taxing it back can be thought of as creating government debt, or a requirement for government borrowing. We are used to the government allowing certain privileged investors the opportunity to be paid interest for depositing money at the Bank of England: investors buy government bonds (‘gilt-edged’ securities): as risk-free an investment as exists. However, the terms ‘debt’ and ‘borrowing’ are misleading.

The government’s bank, the Bank of England, is unique in the UK (although with counterpart central banks in similar, advanced economies), because it and it alone can and does directly create pounds sterling. If the government needs pounds, the Bank of England creates them at the stroke of a computer key. The government appropriates those funds via parliamentary vote, and deploys them, through the Treasury and government departments. There are also technical means – such as buying back quantities of securities – by which the Bank of England can put money directly into the economy without going via parliamentary appropriation and the Treasury. This process is known as ‘quantitative easing’.

During the pandemic, the government budget deficit – the annual difference between its expenditure and its receipts – reached a peacetime record of 15 per cent of GDP (over £300bn a year). The level of deficit has fallen, as noted above. Normally, we might expect a downward trend to continue. Nothing, any longer, is normal. Roughly similar levels of deficit to those in the main pandemic period now look vital to the country’s survival, without the emergence of a less dire, but also less likely, scenario. (Relying on the sale of ‘gilts’ to minimise the deficit, should that be desired, is tricky: with inflation far higher than the interest rate the Bank of England is offering, investors may prefer to look elsewhere).

There’s a catch to deficit spending. Pumping additional money into an economy unable to absorb it, because its available human and material resources are already operating at capacity, will tend to stoke inflation. Clearly, any additional, excessive inflationary pressure must be avoided. However, a failure to provide the money needed to avoid the economic and social heart attack of mass business and household defaults and consequent destitution, would be even worse.

Defrost the UK!

Economies around the world have been throttled by pandemic-induced disruption of supply chains and labour markets. This can be reversed by coordinated international action. However, it is a complex situation, and not under UK control. We must rely largely on our giant allies, the USA and the EU: and even they don’t have unlimited ability to direct events.

The UK has, uniquely, seriously added to such structural problems, because of the Brexit rammed through by Boris Johnson, David Frost and the ERG. Brexit’s economic damage can be reversed, rapidly, provided that the UK and EU agree on appropriate emergency arrangements, taking the country out of the Frost Brexit deep-freeze, by allowing the UK to participate fully, or substantially, in the EU’s single market common regulatory zone and its customs union – including freedom of movement for people – for an interim period, pending discussions on a longer-term way forward, once the crisis is well under control. (This would have the considerable additional benefit of removing, at a stroke, the border in the Irish Sea, the practical issues surrounding the implementation of the Northern Ireland Protocol, and the political disruption related to them).

The fact that, facing catastrophe, there is still a widespread assumption among commentators that such solutions are “unrealistic”, “politically impossible”, or “only attainable after another decade or more” shows how disconnected some UK (and EU) political discourse has become from the scale and imminence of the emergency. Like Morgenstern’s accident victim, many seem to be trying to convince themselves that it is all just a bad dream.

Win the war, and face the facts

Putin’s war has been a major factor in the energy price shock, both by actually constraining gas supply and, crucially, by placing a large question mark over the scale and reliability of future supply.

Other factors independent of Russia, such as Chinese energy demand, and the self-harming Johnson-Frost-ERG Brexit as well as other home-grown policy failures, are having a significant impact on the UK’s energy crisis.

The notion that forcing Ukraine to give in to Putin would be likely to reverse the shock, or a good proportion of it, is fanciful. Anyone who didn’t already understand that Russia is an untrustworthy and unscrupulous supplier, should by now have got the message, irrespective of the wider (overwhelming) arguments against conceding to such a regime.

Defeating Putin and his faction is vital. But it would be foolhardy to assume that their departure from the scene will, or should, lead to the full restoration of Russian energy supplies westwards. It would be equally foolish to assume that such supplies could ever again be considered a reliable basis for any American-allied country’s energy security; unless there is a newly Trumpian administration in Washington, in which case we have lost. The assumption will, instead, need to be that demand must be met from elsewhere.

In the short term, there may be some scope for purely internal UK measures to free up effective, productive, human and material resources, but their impact is likely to be marginal.

Enhancing non-EU immigration (Brexit or no Brexit; it makes no difference) to increase labour supply where needed could have a significant beneficial impact.

In extremis, commandeering UK North Sea hydrocarbon production for purely UK use might be considered. But it is complicated, legally, politically and technically. And it could encourage others to take similar ‘selfish’ action, potentially with essential supplies – energy or otherwise – leaving the UK dangerously exposed.

Big government

We are in the throes of a climate emergency and now we have an energy security crisis on top. The UK, and its international partners, have finally got to bite the bullet and execute a gigantic energy transition. We need to get from carbon to zero carbon; and from geo-strategically reckless, vulnerable and fragmented energy supply to a situation which is secure, resilient and integrated. In Europe, between like-minded allies, that requires, among other things, a robust, continental-scale energy system.

The investment required for the UK’s transition is enormous. Estimates vary. Let’s say £500bn over the next decade: an average of £50bn a year. But we need to move faster; to do far more than currently envisaged in the next five years. So add, maybe, £60bn or more to that annual government budget deficit. And don’t forget that, over and above anything which can be achieved by genuine efficiency savings, badly stretched vital services will still need major budgetary enhancements (much more cash!): that means spending further tens of billions of pounds extra every year.

Again, whether for the energy investment alone, or the other exceptionally important and urgent issues, there is no possibility of action on such a scale without the government taking the lead. It is government’s job to harness human and material resources, creating, appropriating and deploying public money to tackle the challenge.

That means, by any reasonable understanding of the term, big government: detailed, direct government involvement in key aspects of the economy – energy and other essentials – at a minimum. Government expenditure will probably need to run at around 50 per cent of GDP, several percentage points higher than it is now. It implies government deficit spending of perhaps 15 per cent of GDP – historically high in peacetime – maybe for five years.

In short, we will need urgent measures to maximise the UK’s available, productive resources; and higher government spending; and higher government budget deficits; and higher taxes, primarily on those most able to bear them.

The Eurozone and the EU as a whole will, also, need to show great fiscal flexibility if they, and we, are to survive and prosper.

Patriotic duty

The urgency, scale, sophistication and complexity of the response required from the UK’s government is such that, on the basis of the statements by the Conservative Party leadership candidates, their favourite economists and other supporters, there seems to be no credible prospect of any likely cabinet formed by them recognising, let alone delivering, what is needed to address the challenge.

It might surprise some, but most MPs, across party divides, know it. And they know that, in the national interest, this cannot stand. They also know that the country needs them to do their patriotic duty, protecting and promoting the security, prosperity and well-being of the UK, which may well require them to form a cross-party governing majority, supporting one of their number to lead a new cabinet.

Many haven’t fully woken up to what, deep down, they know to be right. Others have, but haven’t yet worked out how to take control.

A general election might help, if it resulted in the election of a competent government. It would need to be held very soon. But that prospect seems faint. Of course, surprises do happen…

One thing is for sure: whoever walks into 10 Downing Street to take over from Boris Johnson will inherit perhaps the worst mess since Churchill took over from Chamberlain in 1940.

For Rishi Sunak or Liz Truss to avoid their legacy being total UK blackout, followed by total wipeout, they will have to shed their ideological baggage and the worst of their advisors, and gain a ton of humility and courage, and a touch of greatness. They will need to understand, fast, what must be done and why, and be ready to face down and outmanoeuvre the extremist, solipsistic, obscurantist minority, primarily from their own party, who will be undermining them in the House of Commons.

In those tasks, we all wish the next prime minister well. There is no prize money for successful completion. Just the thanks of a grateful nation.

[j1]Grammar pedant alert!: in order to avoid ending the sentence with a preposition, strictly speaking this should read “to which we are about to come back”. However, I realise this may sound too formal?