I have been suggesting that interest rate rises are fuelling inflation. I have created a model of a company that is largely service-based to explore my suggestion. Using that model I show that it is more likely that interest than wages push up prices.

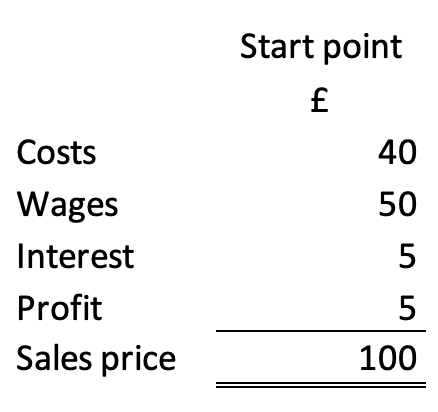

This is the starting point for this model:

The figures are representative: they are denominated in monetary units (thousands or millions: it makes no difference) but also indicate the percentage split in the company’s cost base. The proportion of wages suggests it is service orientated, as most companies are.

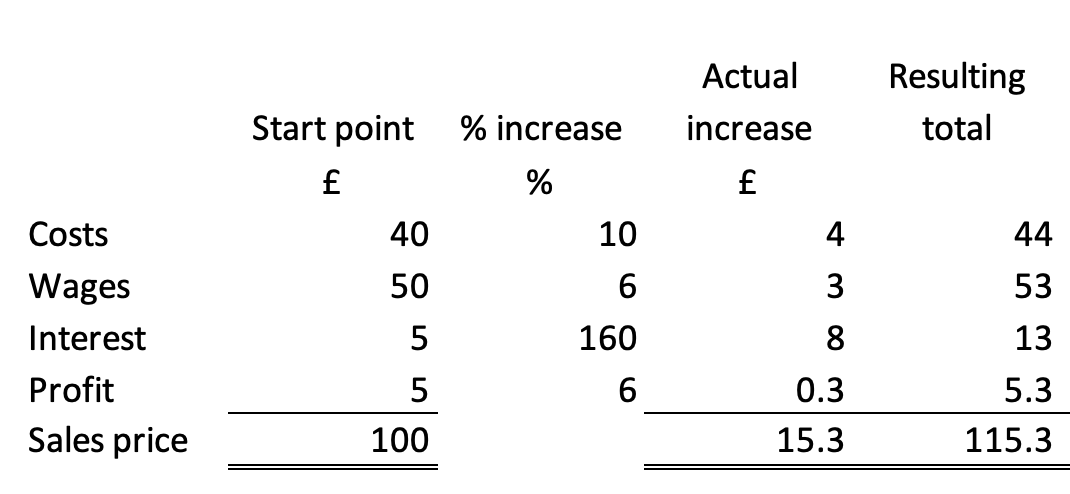

Then I suggest that adjustments for inflation be taken into account, as follows:

Bought-in costs have increased by 10 per cent – roughly the rate of inflation in the last year.

Wage increases have been kept to 6 per cent – which will be tough on many staff.

The big increase is, however, in interest costs. The company pays interest at 3 per cent over bank base rate. So, the rate has grown from near enough 3 per cent to 8 per cent, or a growth of about 160 per cent.

In comparison, profits have only been targeted to increase at the same rate as wages.

The resulting overall cost increase is 15.3 per cent, with more than half of that being due to interest, which imposes a bigger cost increase than external costs and the wage settlement combined.

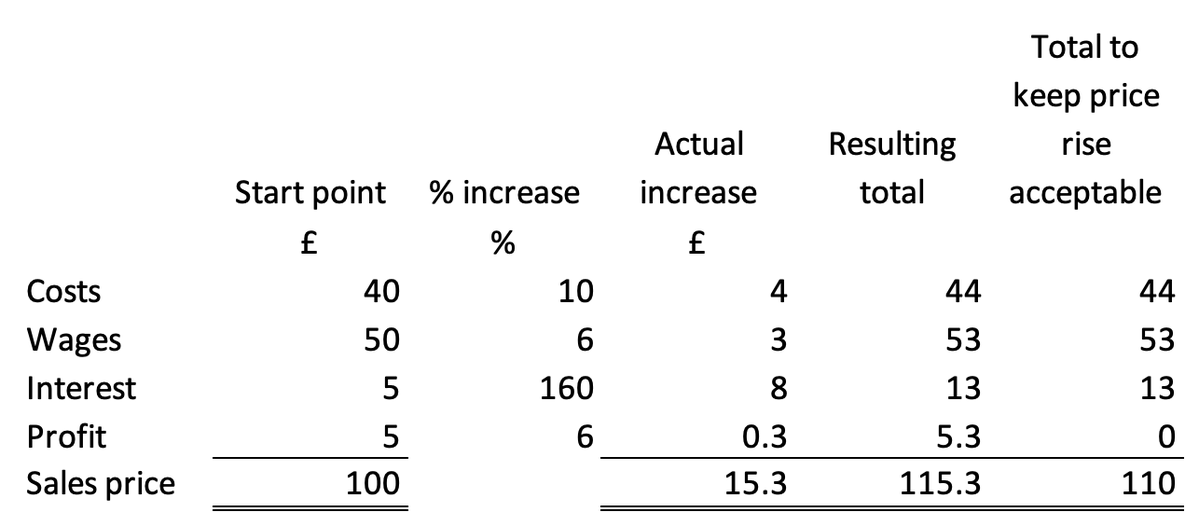

Let’s presume the company realises that the market will not accept a 15.3 per cent price increase, and it keeps it to 10 per cent. This is the result:

Profits have now been eliminated. The company’s future is, then, in doubt.

I stress that this is a model.

I would add that the assumptions seem fair, as does the cost structure, although these (of course) vary widely.

My points are threefold.

First, it is not wages that are driving up inflation.

Second, it is interest rate rises that are driving up prices.

And third, interest rate rises are now so extreme that many businesses will face the threat of failure.

The Bank of England is welcome to use this model, but I doubt that they will. That’s because this model makes clear that we face a crisis created in Threadneedle Street, but they are unlikely to accept that.

And that’s why we face desperate economic times.